Let’s start with the bill from the city. The tax bill has four components, each managed by a separate level of government or board.

| Code on the tax bill | Meaning | Responsibility |

| M-Municipal | City of Burlington | Mayor and council |

| R-Region | Halton Region | Regional Chair and council |

| P-Police | Halton Police Services | Halton Police Board |

| E-Ed | Board of Education | Province of Ontario |

Getting four bills would make everyone’s life more complicated and make issuing and collecting the bills more expensive. The one-bill approach makes sense from an efficiency point of view.

Next, we have to talk about new assessments. The term “new assessments” refers to new tax money paid by new homes, condos, and businesses. A farmer’s field, in Milton, becomes a new subdivision, and the tax revenue Milton collects from the land increases. In Burlington, total tax revenue is increasing by 8.3% but, after factoring in new assessments, existing homeowners will see a tax increase of 7.51%. Predicting when a new condo will be finished is difficult so the city uses the “Tax Rate Stabilization” reserve fund as a buffer. If more new assessments or taxpayers come on stream in 2025 the extra money will flow into the reserve fund, and with fewer new assessments money will flow out of the reserve fund.

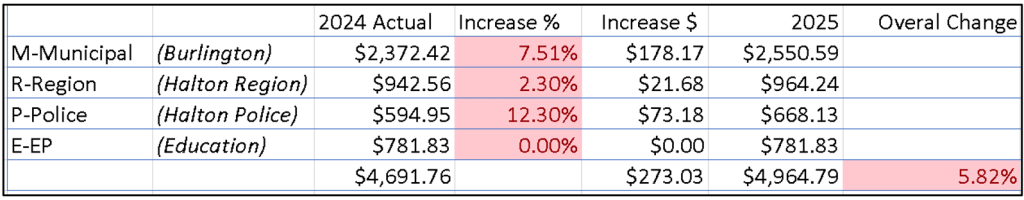

On December 11th, 2024, the Region finalized their tax increase and the Halton Police tax increase, all the numbers are in and here is how it looks.

| Who | Total tax revenue increase | Increase to existing taxpayers (after new assessments) |

| Burlington | 8.3% | 7.51% |

| Halton Region | 4.1% | 2.3% |

| Police Services | 14.3% | 12.30% |

| Education | 0% | 0% |

Now that everything has been finalized and using a sample tax bill this is what the increase is. The 2024 actual numbers on your bill or your landlord’s bill will be different but the percentage increases will be the same.

Burlington Facts:

8.3% – the total increase in tax revenue from new and existing home and business owners.

7.51% – the tax increase to existing home and business owners.

5.82% – the overall increase on our tax bill.

5.5% – the increase to water and Wastewater charges, billed separately by the Region of Halton.

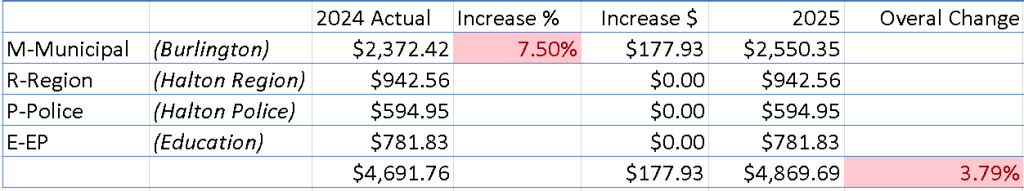

How does Craig Millar, our CFO, calculate 3.79%?

During the November 25th, 2024 council meeting, Councillor Sharman asked Millar what the tax increase was. With a complex answer, Millar stated 3.79%. If you make a mathematical assumption that the region, police, and board of education do not increase their taxes at all you can calculate 3.79%.

This is a curious way to present what was at the time a 7.5% property tax increase.